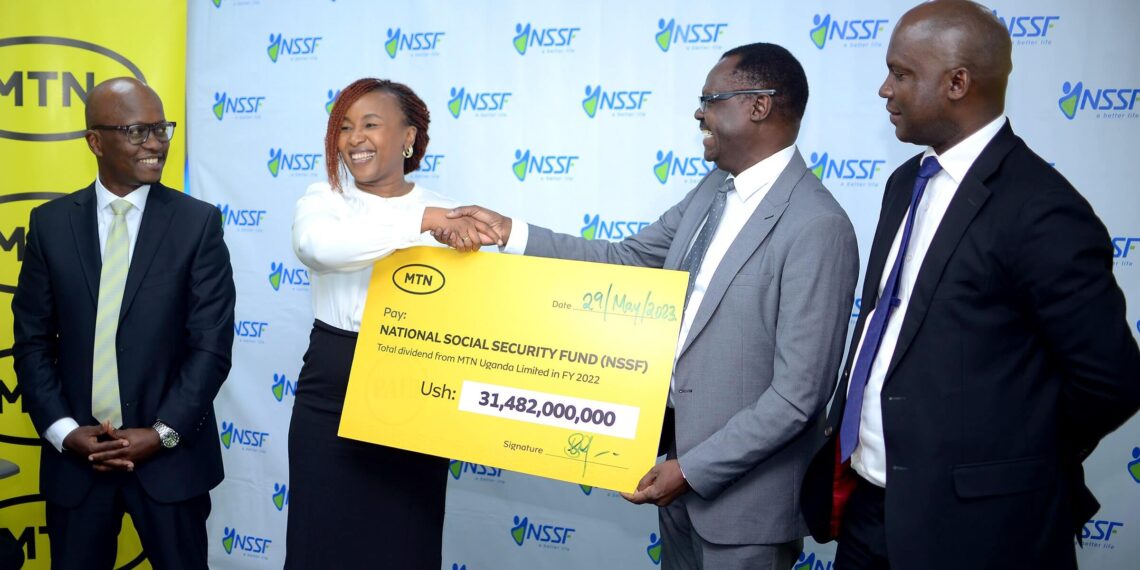

The National Social Security Fund (NSSF) of Uganda has achieved a remarkable milestone, earning a total of shs 31.5 billion in dividends for the year ended December 31, 2022, from its investment in MTN Uganda, the country’s largest telecommunications operator.

KAMPALA, UGANDA | NOW THEN DIGITAL — The National Social Security Fund (NSSF) of Uganda has achieved a significant milestone by earning a total of shs 31.5 billion in dividends for the year ending December 31, 2022, from its investment in MTN Uganda.

This marks the largest dividend ever earned by the Fund, in addition to the shs 9.32 billion earned from the telecommunications giant last year.

NSSF’s Investment in MTN Uganda

NSSF Uganda, the largest national savings fund in East Africa, made a strategic move by investing shs 360 billion in December 2021 to acquire 1.98 billion shares in MTN Uganda during its Initial Public Offering (IPO).

This investment has proven to be highly fruitful, solidifying NSSF’s position as the second-largest shareholder in MTN Uganda, holding an 8.84% stake.

Strong Performance and Market Leadership

Patrick Ayota, Acting Managing Director of NSSF, expressed confidence in the decision to invest in MTN Uganda, citing the company’s track record of success and market leadership.

He praised MTN Uganda’s significant role in the country’s telecom and fintech sectors, highlighting its high margins, consistent growth, and solid management team as contributing factors to the attractive returns on invested capital.

Long-Term Value Creation and Diversification

Ayota emphasized NSSF’s commitment to long-term value creation and its enthusiasm for the telecom business. He acknowledged the investment’s alignment with NSSF’s diversification strategy and its corporate goal of growing the Fund to shs 20 trillion by 2025.

Investing in the telecommunications sector, along with emerging sectors like fintech, remains a key part of NSSF’s plan to support the economy.

MTN’s Appreciation for NSSF’s Investment

Sylvia Mulinge, Chief Executive Officer of MTN Uganda, commended NSSF for its significant investment in the telecom company. She recognized NSSF’s role as a shareholder representing numerous Ugandans with a stake in the Fund and expressed MTN’s commitment to delivering value to all its stakeholders.

Mulinge reaffirmed MTN’s dedication to creating shared value for its shareholders, including smaller pension funds and SACCOs that represent millions of Ugandans.

Dividend Payouts and Commitment to NSSF’s Objectives

MTN Uganda will distribute the final dividend for the financial year 2022, amounting to shs 5.5 per share and totaling shs 123.1 billion, to all registered shareholders by June 22, 2023. This final dividend follows two interim dividends paid out last year in September and December, totaling shs 232.8 billion.

Mulinge emphasized MTN’s recognition of NSSF’s significant contribution to social security and reassured their commitment to fulfilling the investment objectives and goals of the Fund.

Overall, NSSF’s investment in MTN Uganda has proven to be highly successful, providing substantial returns and supporting the Fund’s growth objectives.

HAPPENING: The Fund invested Ushs 360b in December 2021 to acquire 1,980,000,000 shares in @mtnug following the Initial Public Offer, becoming the second-largest shareholder with 8.84% shareholding.

We're privileged to host the MTN Uganda CEO & CFO for the dividend payout for… pic.twitter.com/VK2gT6cH8z

— NSSF Uganda (@nssfug) May 29, 2023

Investment in MTN Uganda:

.@AyotaPatrick: The Fund invested Ushs 360b in December 2021 to acquire 1,980,000,000 shares in MTN Uganda following the Initial Public Offer. @nssfug is the second-largest shareholder in @mtnug, with 8.84% shareholding.We made this decision because as… pic.twitter.com/IfZ5jQQFol

— NSSF Uganda (@nssfug) May 29, 2023

Editor’s Note: We would appreciate it if you could let us know if any of our content is inaccurate or outdated at press@nowthendigital.com.