Uganda’s headline inflation rate for the 12 months ended April 2023 decreased to 8.0%, down from 9.0% in March 2023.

KAMPALA, UGANDA | NOW THEN DIGITAL — Uganda’s annual headline inflation for the 12 months ending in April 2023 decreased slightly to 8.0% from 9.0% in March 2023. This was mainly driven by a decrease in core inflation, which fell to 6.8% from 7.6% in March 2023.

The Food Crops/Related Items and Energy Fuel and Utilities components of the Inflation Index also reduced to 25.3% and 2.1%, respectively. However, inflation still remains above the central bank’s target of 5%.

The local stock market, represented by the Uganda Securities Exchange Local Share Index-USE LSI, increased by 1.2% in April 2023, while the regional markets, benchmarked index (Nairobi Securities Exchange All Share Index -NASI), experienced a loss of 7.5% during the same period. The Nairobi market continues to face the effects of heightened political tensions and weakening Kenyan

Ugandan Shilling Gains 1.1% Against the US Dollar

The Uganda shilling gained 1.1% against the US dollar in April, closing at USD/UGX 3,703, compared to USD/UGX 3,744 at the end of March 2023.

The exchange rate continues to be driven by the value of imported items relative to the foreign currency inflows into the country.

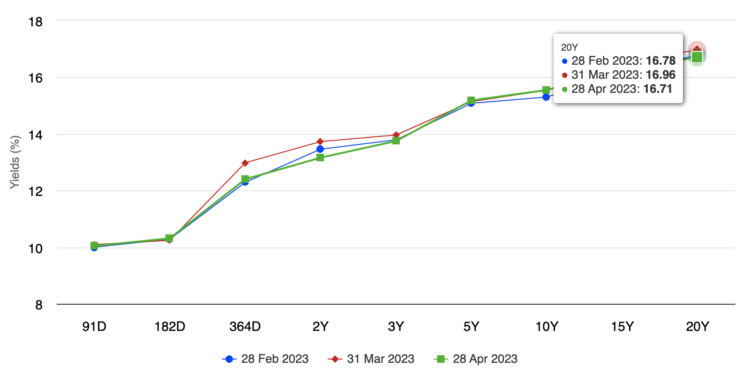

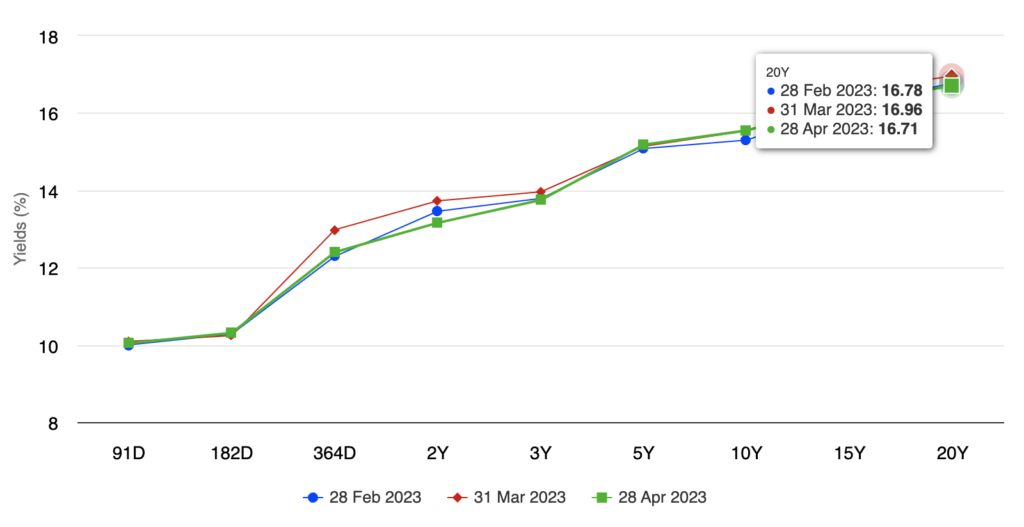

Interest Rates Experience a Slight Drop

Interest rates experienced a slight drop during April, with an active primary and secondary market.

There were two Treasury bill auctions in April 2023, with the yields at cut-off prices for the last auction of the month at 12.5% (364-day), 10.2% (182-day), and 10.0% (91-day).

The one scheduled Treasury Bond auction saw yields cut-off prices of at 13.5% (2Y) and 15.7% (10Y), respectively.

Monetary Policy Committee Maintains Central Bank Rate

The Monetary Policy Committee held during April 2023, and the Central Bank Rate (CBR) remained unchanged at 10%. The CBR is a tool used in monetary policy to control the supply of money in the economy to contain inflation.

Although high inflationary pressures were beginning to fade, the Bank of Uganda observed that there were still uncertainties surrounding the outlook.

Therefore, interest rates are likely to remain firm to contain inflationary pressures. The next monetary policy update will be in June 2023.

Local Stock Market Increases, While Regional Markets Decline

The local stock market, represented by the Uganda Securities Exchange Local Share Index-USE LSI, increased by 1.2% in April, while the regional markets, benchmarked index (Nairobi Securities Exchange All Share Index -NASI), experienced a loss of 7.5% during the same period.

The Nairobi market continues to face the effects of heightened political tensions and a weakening Kenyan Shilling. From January 2023 to April 2023, the local and regional markets have lost 2.8% and 17.1%, respectively.

Conclusion

Despite a slight drop in inflation and interest rates, inflation still remains above the central bank’s target of 5%. The Central Bank Rate remains unchanged at 10% as uncertainties surrounding the outlook persist.

The local stock market has seen some gains, while regional markets continue to face challenges. The next monetary policy update is scheduled for June 2023.

Editor’s Note: We would appreciate it if you could let us know if any of our content is inaccurate or outdated at press@nowthendigital.com.