Stanbic, Uganda’s largest commercial bank by assets, has joined forces with technology giant IBM to accelerate its transformation into a modern, digitally-led bank.

KAMPALA, UGANDA | NOW THEN DIGITAL — Stanbic Bank Uganda Holdings Limited (Stanbic Bank Uganda), the largest commercial bank in Uganda, has chosen IBM’s Cloud Pak for Integration (CP4I) to revamp its business operations and enhance customer experience.

This strategic move aims to accelerate the bank’s digital transformation, optimize operational efficiency, and provide secure and compliant banking-as-a-service.

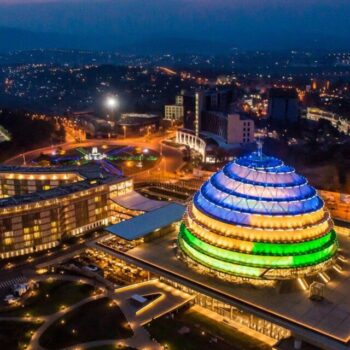

Uganda’s Digitization Journey and the Role of Smart Policies

In response to the pandemic, Uganda has prioritized the implementation of smart policies to address societal challenges and stimulate economic growth, aligning with the national development plan – Uganda Vision 2040.

According to the United Nations Development Programme (UNDP), Uganda has made significant strides in its digitization journey by expanding mobile network coverage to meet the demands of its increasingly digital-first population. It is projected that 4 million new mobile subscribers will be active by 2025.

Integration Capabilities and Enhanced Banking Experience

By leveraging IBM’s CP4I, Stanbic Bank Uganda can integrate its payment systems to support the functionalities of core banking applications and mobile banking operations.

The secure platform enables the bank to onboard and manage new application programming interfaces (APIs) internally and externally, enabling faster time-to-market for innovative solutions such as FlexiPay. This integration enhances the banking experience for customers at every touchpoint.

Strengthening the Ecosystem and Meeting Digital Customer Expectations

Furthermore, adopting CP4I allows Stanbic Bank Uganda to meet the rising digital customer expectations by strengthening its ecosystem through collaborations with fintechs, neo-banks, and telecom partners. This strategic move positions the bank to offer integrated and seamless banking experiences, prioritizing agility, security, and quality of integration.

Emmanuel Serunjogi, Head of Partnerships and Ecosystems at Stanbic Bank Uganda, emphasizes the significance of digital services for their growing base of e-customers, who prefer transacting via their mobile devices. Through secure API integration with ecosystem partners, the bank is able to meet customer needs and expectations effectively.

“Through working with IBM, Stanbic Bank Uganda can offer integrated and seamless banking experiences which enhances the user experience for our customers. In this process, agility, security and quality of integration were prioritised” says Emmanuel Serunjogi, Head of Partnerships and Ecosystems, Stanbic Bank Uganda.

“Digital services are key to our growing e-customers who prefer transacting from the palm of their hands. By integrating secure APIs with our ecosystem partners, we are able to meet our customer’s needs and expectations”, concluded Serunjogi.

Hybrid Cloud Approach for Competitiveness and Compliance

Stanbic Bank Uganda’s adoption of a hybrid cloud approach further enhances its competitive edge by enabling flexibility in response to evolving customer and business demands while adhering to strict industry regulations.

IBM’s Commitment to Expediting Digital Transformation

Julia Carvalho, General Manager for IBM Africa Growth Markets, expresses delight in collaborating with Stanbic Bank Uganda to expedite their digital footprint and elevate the overall customer experience.

Leveraging IBM’s expertise, the partnership aims to empower the bank to expand its reach, cater to broader audiences, and provide cutting-edge digital solutions that meet evolving customer needs.

The joint efforts between IBM and Stanbic Bank Uganda will enable the bank to offer an unparalleled customer experience and foster the growth of the financial digital ecosystem in Uganda.

“We are pleased to be on a journey with Stanbic Bank Uganda to expedite their digital footprint and elevate the overall customer experience. By leveraging our expertise, we aim to empower the bank expand its reach, cater to wider audiences, and provide cutting-edge digital solutions that meet the evolving needs of customers. Our joint efforts will enable the bank to offer an unparalleled customer experience and drive the growth of the financial digital ecosystem in Uganda.”

Aligning with Global Trends in Banking

Stanbic Bank Uganda’s decision aligns with global trends within the banking industry, where end-to-end digitization is being embraced to reshape operations and drive innovation.

This strategic move resonates with the imperatives outlined in IBM Institute for Business Value’s 2022 Global Outlook for Banking and Financial Markets report.

Editor’s Note: If you find any of our content to be inaccurate or outdated, please contact us at press@nowthendigital.com

You’re reading nowthendigital.com — which breaks the news about Uganda, Kenya, Nigeria, South Africa and the rest of the world, day after day. Be sure to check out our homepage for all the latest news, and follow NOW THEN DIGITAL on YouTube, Google, Web Stories, Google News, Medium, LinkedIn, Twitter, Reddit, Pinterest, Linktr, Buy Me a Coffee, and Flipboard to stay in the loop.